The New Rules of Healthcare Platforms (Part 2): Pipe Scale vs. Platform Scale

Vince KuraitisPlatform businesses scale differently than traditional businesses. Platforms scale through network effects.

Vince KuraitisPlatform businesses scale differently than traditional businesses. Platforms scale through network effects.

In the previous post, we introduced and described a widely used metaphor: pipes vs. platforms.

- Traditional businesses are pipes. Their value chains are linear. Value is added at sequential stages before a final product or service is delivered to consumers at the end of the pipeline.

- Platforms do not produce goods or services themselves—they make connections among stakeholders and facilitate value exchange among those stakeholders. Value is created outside the platform.

Both pipeline businesses and platform businesses strive to achieve scale—but the type of scale they strive for is vastly different. In this post, we’ll explain how pipeline businesses strive for economies of scale (on the supply side) and how platform businesses scale through network effects (on the demand side).

Pipe Scale–Economies of Scale (Supply Side)

In the industrial economy, businesses scaled through traditional economies of scale–higher volumes of output lead to lower costs of production per unit.

In their leading book Platform Revolution, Parker, Van Alstyne and Choudary explain economies of scale:

In their leading book Platform Revolution, Parker, Van Alstyne and Choudary explain economies of scale:

In the twentieth-century industrial era, giant monopolies were created based on supply economies of scale. These are driven by production efficiencies, which reduce the unit cost of creating a product or service as the quantities produced increase. These supply economies of scale can give the largest company in an industrial economy a cost advantage that is extremely difficult for competitors to overcome…

Boston Consulting Group Experience CurveIn the late 19th and early 20th Centuries, supply side economies of scale created giant businesses of the industrial era. Antitrust legislation was enacted to combat monopolistic practices.

Boston Consulting Group Experience CurveIn the late 19th and early 20th Centuries, supply side economies of scale created giant businesses of the industrial era. Antitrust legislation was enacted to combat monopolistic practices.

The Boston Consulting Group used its “Experience Curve” diagram to illustrate economies of scale. Note that the vertical axis is “cost per unit” and the horizontal axis is “total units”.

Platform Scale—Network Effects (Demand Side)

In the network economy, platform businesses scale through demand side economies of scale, aka network effects. We use these terms interchangeably.

Network effects are the demand side counterpart to economies of scale. They function by increasing the customer’s desire to pay as compared to decreasing the producer’s cost of production.

Network effects are the demand side counterpart to economies of scale. They function by increasing the customer’s desire to pay as compared to decreasing the producer’s cost of production.

Again, we turn to Platform Revolution:

The network effect represents a new economic phenomenon, driven by technological innovation.

By contrast with supply economies of scale, demand economies of scale take advantage of technological improvements on the demand side–the other half of the profit equation from the production side.

Demand economies of scale are driven by efficiencies in social networks, demand aggregation, app development, and other phenomena that make bigger networks more valuable to their users. They can give the largest company in a platform market a network effect advantage that is extremely difficult for competitors to overcome.

Demand economies of scale are the fundamental source of positive network effects, and thus the chief drivers of economic value in today’s world. This is not to say that supply economies of scale no longer matter; of course they do. But demand economies of scale, in the form of network effects, have become the most important differentiating factor….

Demand economies of scale are the fundamental source of positive network effects, and thus the chief drivers of economic value in today’s world. This is not to say that supply economies of scale no longer matter; of course they do. But demand economies of scale, in the form of network effects, have become the most important differentiating factor….

In the twenty-first-century Internet era, comparable monopolies are being created by demand economies of scale.

Network effects can result in winner(s)-take-all dynamics, resulting in highly concentrated markets. While there is consensus that antitrust laws aren’t effective against companies that have scaled through demand side economies, legislators around the world are still grappling to develop an effective regulatory framework against monopolistic practices.

Network effects can result in winner(s)-take-all dynamics, resulting in highly concentrated markets. While there is consensus that antitrust laws aren’t effective against companies that have scaled through demand side economies, legislators around the world are still grappling to develop an effective regulatory framework against monopolistic practices.

We’ll have a lot more to say about network effects in future posts, but for now we’ll keep it simple. The basic idea is that a product or service gains value as more people use it.

Randy WilliamsComparisons of Supply vs. Demand Side Economies

Randy WilliamsComparisons of Supply vs. Demand Side Economies

Supply side economies of scale have become less powerful in the digital age. Ben Robinson of Aperture Consultancy explained why:

The challenge now is two-fold. Firstly, the broadcast channels that companies used to advertise are being eroded at the same time as there are many more demands on the consumer’s attention, making it harder to engage in the same type of mass-marketing.

The second issue is that, since consumers are now online, we can know much more about them, as well as have a direct relationship with them. This means that at the same time as it’s become possible to operate profitably at smaller scales of production, it’s become possible to produce goods which cater to smaller customer demographics, and to reach these customers directly — which explains the rise of artisanal goods and direct-to-consumer brands.

But, for digital goods, it goes further, artificial intelligence increasingly allows platforms to match services to customers as well as personalize services to each customer.

To put it another way, in the digital age, the mass consumer is dead.

Robinson’s graphic below compares a central difference between supply side economies of scale vs. demand side economies of scale (network effects). Note that the vertical axis represents market share and that the horizontal axis represents output.

Companies can have both supply side and demand side economies of scale. For example, Amazon’s e-commerce business has traditional economies of scale–extensive regional warehouse facilities, a delivery fleet of airplanes and trucks, buying power from sheer size, etc.

Companies can have both supply side and demand side economies of scale. For example, Amazon’s e-commerce business has traditional economies of scale–extensive regional warehouse facilities, a delivery fleet of airplanes and trucks, buying power from sheer size, etc.

Amazon Marketplace also has demand side economies of scale. Amazon Marketplace includes third-party sellers who are listed on Amazon’s website. More sellers attracts more buyers which attracts more sellers, and so on. Third-party sellers accounted for 57% of total sales in Q2 of 2022.

Amazon’s e-commerce evolution illustrates the transition from pipe to platform that many incumbent companies have the opportunity to make. Amazon’s website started as a bookseller (pipe), transitioned to a broader e-commerce store (still a pipe), then opened Amazon Marketplace to a broad ecosystem of third-party sellers (a platform).

Supply side and demand side economies both can have limits. There’s potential for diseconomies of scale, which happen when a company or business grows so large that the costs per unit increase, e.g., overcrowding, where employees and machines get in each other’s way, lowering operational efficiencies, operational waste, due to lack of proper coordination, or mismatch in the optimum level of outputs within different operations.

Platforms can experience negative network effects, e.g., through congestion or pollution.

Summarizing

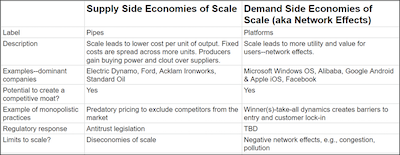

The table below summarizes some of the key concepts relating to supply side economies of scale vs. demand side economies of scale (aka network effects):

Platform business scale differently than traditional businesses:

- Traditional businesses scale through supply side economies of scale

- Platform businesses scale on the demand side through network effects

Additional Readings

- Platform Revolution Parker, Van Alstyne & Choudary; 2016

- Platform Scale for a Post Pandemic World Sangeet Paul Choudary, 2021

- Network Effects and Demand-Side Economies of Scale YouTube video by economist Ashley Hodgson, 2021

- The New Moat in Financial Services Ben Robinson, Aperture; December 17, 2019

- What is Demand Side Economies of Scale? Stratology, 2022

- SUPPLY SIDE Economies of Scale, Network Effects Network Effects, presentation by Andreesen Horowitz; March 7, 2016

Article Series - The New Rules of Healthcare Platforms

- Tags:

- Amazon Marketplace

- antitrust legislation

- Aperture Consultancy

- app development

- artificial intelligence (AI)

- Ben Robinson

- Boston Consulting Group Experience Curve

- demand aggregation

- demand economies of scale

- digital goods

- effective regulatory framework

- efficiencies in social networks

- Geoffrey G. Parker

- linear value chains

- Marshall W. Van Alstyne

- monopolistic practices

- network effects

- pipeline businesses

- platform businesses

- Platform Revolution

- positive network effects

- Randy Williams

- Sangeet Paul Choudary

- supply economies of scale

- The Healthcare Platform Blog

- value exchange facilitation

- Vince Kuraitis

- Login to post comments